Are you Carrying too Much Debt

A Market review

for April 22nd 2024

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

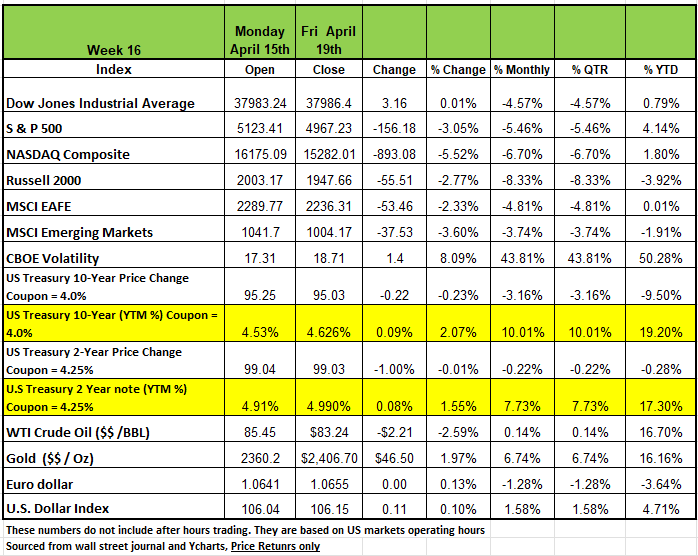

Three of the 4 major indices were in the red last week, as investors digested a mixed round of quarterly financial results and escalating turmoil in the Middle East. The DOW was the only index with a positive return ever so slightly last week with a +0.01% increase The NASDAQ had the largest drop with a -5.52% decline followed by the S & P 500 index falling -3% on the week, much of the decline coming from technology and consumer discretionary sectors and the Russell 2000 decline -2.77%. The S&P dropped below the 5000 mark and ended Friday's session at 4,967.23, the third straight weekly decline.

All the indices are down for the month of April with declines ranging between -4.5% on the low end and -8.33% on the higher end. Three of the Four indices are It is still in positive territory for 2024 with a year-to-date range between +0.79% and +4.14% The only loser YTD is the Russell 2000 posting a -3.92% return.

The week's drop came amid a mixed round of corporate results. Among the S&P 500 components that released quarterly reports last week, 79% of those released had better-than-expected earnings, while only 55% had better-than-forecast revenue according to Bloomberg data. Adding to investor concerns, Chicago Fed President Austan Goolsbee said progress made by the Federal Reserve in easing inflationary pressures has "stalled," and it "makes sense" to extend the pause rather than cut interest rates. Former Treasury Secretary Larry Summers expre4ssed more concerns of the likelihood of a rate increase if inflation data continued to reignite.

In addition to financial and economic news the Tumultuous situation in the Middle East has escalated as Israel launched a retaliatory strike on Iran, this also weighed on the market as investors worried about potential impacts on oil supplies and energy prices.

On the fixed income side, Treasury Yields rose moderately across all maturity levels last week on the same geopolitical turmoil in the Middle East and comments from Fed officials, both of which led to a reduction in the market expectations for interest rate cuts from the Federal Reserve Bank this year.

Adding to the hawkish speculation on interest rates were several comments made by Fed officials throughout the week. Fed President Jerome Powell implied in an interview with Canadian Central Bank Chief Richard “Tiff” Macklem stated that it may take longer than initially expected to have confidence that inflation is under control and Fed Vice Chair Philip Jefferson said that the Fed’s task to restore 2% inflation is not done yet. But what spooked the markets were comments by New York Fed President John Williams that increasing interest rates would be possible if warranted. Atlanta Fed President Raphael Bostic does not believe it will be appropriate to ease monetary policy until the end of the year. The market implied probability of an interest rate cut during the June 12th meeting dropped from 26% at the beginning of the week to 16% by the end of the week. The market implied Federal Funds Rate at the end of 2024 rose from 4.86 to start the week to 4.94 to end the week.

Sectors

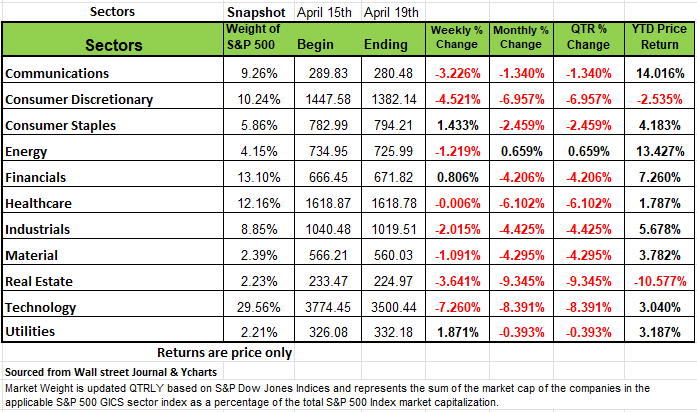

By Sectors 3 of the 11 sectors in the S&P 500 were in the black for the week with Utilities leading the way with a +1.87% return, followed by Consumer Staples +1.4% and Financial +0.8% increase. The rest of the sectors posted declines with the Technology sector posting the largest percentage drop on the week, sliding -7.3%, followed by a -4.5% drop in Consumer Discretionary, a -3.6% decline in Real Estate and a -3.2% slide in Communication Services. Other sectors posting declines included Industrials, Energy, Materials and Healthcare. Gainers in the utilities sector included shares of Consolidated Edison (ED), which rose +3.5% as the energy delivery company maintained its quarterly dividend rate.

Super Micro Computer (SMCI) which has skyrockets this year with a YTD return of +255% on top of last year’s +246% return shares led the tech slide, tumbling -20% ($185.75)on the week, as the company announced its fiscal Q3 earnings release date without offering any preliminary results for the quarter, disappointing investors. The company had released preliminary Q2 results about 11 days before full earnings, boosting its sales outlook.

Weighing down the consumer discretionary sector, shares of Tesla (TSLA) continue to drop -14% as analysts said Chief Executive Officer Elon Musk must address key issues this week, including the debate around the Model 2 vehicle and robotaxis as well as his recent 25% ownership remarks, to ease investor concerns amid waning electric vehicle demand. This comes after the company posted lower Q1 deliveries that missed analysts' expectations earlier this month.

In real estate, shares of Prologis (PLD) fell -13% as the logistics real estate investment trust reported Q1 core funds from operations and revenue that only matched Street views and tempered expectations for the full year amid a slowdown in leasing activity.

This week more earning reports will be released from a number of heavyweight companies including Verizon Communications (VZ), Visa (V), Tesla, Pepsico (PEP), GE Aerospace (GE), Meta Platforms (META), International Business Machines (IBM), AT&T (T), Boeing (BA), Microsoft (MSFT), Alphabet (GOOGL), Merck (MRK), Caterpillar (CAT), Exxon Mobil (XOM) and Chevron (CVX).

Economic data due this week will feature Q1 gross domestic product as well as the latest consumer price index, a closely watched inflation reading. Other reports expected this week include March new home and pending home sales as well as durable goods orders.

Overwhelming Consumer Debt

Consumers are carrying over a trillion dollars in credit card debt, if you are in this carrying high balances on your credit cards and struggling to make all of your payments on time, you may want to take some action to fix your financial situation. Consumers that have multiple credit cards often struggle to make payments on time, for one reason their paycheck rarely lines up with the due date of the bills that they need to pay. So very often they make payments late and get hit with late charges in addition to the high interest rate on the debt. However there are some solutions to help you get out of this predicament it will take a little discipline and improve your financial well being greatly in a short period of time depending on the amount of debt you are carrying.

Debt consolidation is a debt management strategy that combines your outstanding debt, mostly credit cards, into a new loan with a single monthly payment. There are several ways to consolidate debt. What works best for you will depend on your specific financial circumstances and more importantly your behavior and ability to be disciplined on your future spending.

Before making the decision to consolidate your debt, you need to look very closely at what got you into your situation. Be honest with yourself and whether you will be able to develop the discipline to correct past mistakes. If you are not able to change bad behavior consolidating your debt will just get you into more trouble. Think of it like a diet, the only way you will be successful is to sacrifice, to change your habits, only in this case it is your spending habits that need to change.

Once you have made the commitment to reduce your spending, start off by checking your credit score, you can get a free credit report from all 3 of the major credit reporting agencies each year. Make sure that there are no discrepancies in your report and keep that those numbers in your records for reference so that you can see the improvement over time. If your credit score is lower than 670, debt consolidation may not be a good option for you. Consolidating debt when you have bad credit can be challenging. Although you may be approved for a loan, the interest rates offered to you will likely be high and may negate the savings you hoped to achieve by consolidating your debt. It needs to be analyzed.

It's important to understand that debt consolidation involves taking out a new loan. As with any other type of loan, the application process, and the loan itself can affect your credit scores. Weigh the pros and cons of debt consolidation and how it might affect your credit scores to decide whether it's the right path for you. Also be careful that the loan officer is not trying to influence you if you get approved, very often they will be compensated on the amount of loans they write and will address the benefits not the downside.

The next thing you need to do is create a budget and one that is realistic enough so that you can stick to it. Here is where you need to create a budget that is solely based on needs, eliminate your wants. They will come later. Your needs are simple your housing expenses, your insurance, especially your health insurance, your grocery allowance, transportation cost to and from work, if taking public transportation means being a little inconvenienced for a year or so then make the sacrifice. Look at your utility cost Cell phone, cable, and streaming services, how many subscriptions do you have that get little use? Break it down, the more detailed you can be the better chance you have of eliminating wasted money.

The more disciplined you are and the more sacrifices you make now the quicker you will reduce the expensive debt, which will ultimately result in more money in your pocket at the end of each month.

Weigh the pros and cons of debt consolidation loan and how it might affect your credit scores to decide whether it's the right path for you. Remember debt consolidation is a debt management strategy that combines your outstanding debt into a new loan with one monthly payment. By consolidating multiple credit cards or a mix of credit cards and other loans such as a student loan you can better manage your debt. Remember consolidation does not erase your debt, while your current credit card balances will be paid off, the debt is still on your balance sheet. One big mistake people make when consolidating is that their credit card balances are now cleared, and they tend to go back to the bad spending habits that got them into trouble in the first place. Debt consolidation loans will provide some borrowers with the tools they need to pay back what they owe more effectively. However it can backfire if you do not manage your spending habits.

Keep in mind that the goal of consolidation is twofold. First, consolidation condenses multiple monthly payments, often owed to different lenders, into a single payment. Second, it can make repayment less expensive. By combining multiple balances into a new loan with a lower interest rate, you can reduce cumulative compounded interest, into a simple interest loan.

Types of debt consolidation

There are several ways to consolidate debt. What works best for you will depend on your specific financial circumstances and your ability to control your future financial behavior.

Credit card transfer. One of the lures that cre4dit card companies give consumers is to offer interest free money for 12-18 months on balances transferred over to the new card. These companies know that most consumers will not have the discipline to pay off the loan balance in the interest free time frame. These companies will make their money on the balance at the time the period ends. In some cases, the unpaid balance will be back charged to day one of the transfer. Be careful and read the agreement in detail. If you are not comfortable with these situations you can hire a financial professional to review the details in advance or just avoid the transfer.

Debt consolidation loan. The most common of these are personal loans known simply as debt consolidation loans. Frequently used to consolidate credit card debt, they come with lower interest rates and better terms than most credit cards, making them an attractive option. Debt consolidation loans are not secured debt, meaning the borrower doesn't have to put an asset on the line as collateral to back the loan. However, borrowers will only be offered the best interest rates and other favorable loan terms if they have good credit scores.

Home equity loan or home equity line of credit. For homeowners, it's also possible to consolidate debt by taking out a home equity loan or home equity line of credit (HELOC). However, these types of secured loans are much riskier to the borrower than a debt consolidation plan since the borrower's home is used as collateral and failure to pay may result in foreclosure.

401 (k) loan. You can also borrow against your 401(k)-retirement account to consolidate debts. Although 401 (k) loans don't require credit checks, dipping into your retirement savings is a dangerous prospect, and you stand to lose out on accumulating interest which may impact your future to retire on target. Loans from your 401K plan has limitations, you can only borrow up to 50% of your account balance and it may not exceed $50,000 in total. In addition, the interest owed on a loan from your 401K plan is paid to yourself and is set generally it will be 1-2% above the prime rate. If the markets perform well then you would lose out on the returns such as in 2023 when the market returned +23%

Consolidation can certainly be a tidy solution to repaying your debt, but there are a few things to know before you take the plunge.

Debt consolidation loans and your credit scores

Before you're approved for a debt consolidation loan, lenders will evaluate your credit reports and credit scores to help them determine whether to offer you a loan and at what terms.

High credit scores mean you'll be more likely to qualify for a loan with favorable terms for debt consolidation. Generally, borrowers with scores of 740 or higher will receive the best interest rates, followed by those in the 739 to 670 range. However, if you know that you will need to purchase a large ticket item on credit such as a car be aware that taking out the loan may impact your score and cause you to pay a higher rate on the purchase.

Here are some of the Pros and Cons to consolidating.

Credit Utilization. Your credit utilization ratio, the amount of revolving credit you're using divided by the total credit available to you, contributes to your credit scores. Lenders interpret high credit utilization ratios (usually above 30%) as an indicator of risk. So, if you have several credit cards open and each is carrying a large balance, your credit utilization ratio will be high, which typically translates to lower credit scores. However, credit cards and personal loans are considered two separate types of debt when assessing your credit mix, which accounts for 10% of your FICO credit score. So, if you consolidate multiple credit card debts into one new personal loan, your credit utilization ratio and credit score could improve. Just do not start spending a lot on your credit cards

Payment History. If you have been struggling with high-interest debt, you already know that missed payments can quickly drag down your credit scores. Debt consolidation offers a solution: if you can obtain lower interest rates and lower payments, then it may be easier to meet your monthly obligation and avoid a negative hit to your credit scores.

Cons

Hard Inquiries. When you apply for loans, including those for debt consolidation, potential lenders review your credit reports, which generates what's known as a hard inquiry. Hard inquiries help lenders track how often you apply for new credit accounts. Each new inquiry may knock your credit scores down a few points, so you'll want to be sure that you only apply for loans for which you're likely to be approved.

Newer Accounts. The average age of your accounts has a big impact on your credit scores. Opening a new account will lower the average age of your accounts, and you might see a corresponding drop in your credit scores. Closing credit accounts that have been paid off will generally have the same effect.

Alternatives to debt consolidation

Consolidation isn't the only option for debtholders looking for relief. Consider these alternatives:

Debt management plans. Some non-profit credit counseling services offer debt management programs, where counselors work directly with the creditor to secure lower interest rates and monthly payments. This approach may help you avoid taking out a new loan, but there's a catch. You'll also lose the ability to open new credit accounts as long as the debt management plan is in place.

As mentioned earlier Credit card refinancing involves transferring your debt onto a new balance transfer credit card with an interest rate as low as 0%. This introductory rate is only temporary, it’s a teaser, and these kinds of cards are difficult to get without good credit scores.

Filing for bankruptcy should be a last resort. It is a legal process for individuals and businesses that find themselves unable to pay their debts. During bankruptcy proceedings, a court examines the filer's financial situation, including their assets and liabilities. If the court finds that the filer has insufficient assets to cover what they owe, it may rule that the debts be discharged, meaning the borrower is no longer legally responsible for paying them back.

Bankruptcy can be a good choice in some extreme situations, it's not an easy way out. Bankruptcy proceedings will have a severe impact on your credit scores and can remain on your credit reports for up to 10 years after you file. Bankruptcy should generally only be considered as a last resort. Keep in mind if student debt is part of your liability these loans are non-bankruptable, so you will still have the obligation. Remember it all comes down to your financial behavior.

Juggling multiple debts can be overwhelming, but it's important not to let those bills pile up. With a few deep breaths and some careful consideration, finding a strategy for debt management that keeps your credit healthy is well within your reach.

A Technical Perspective

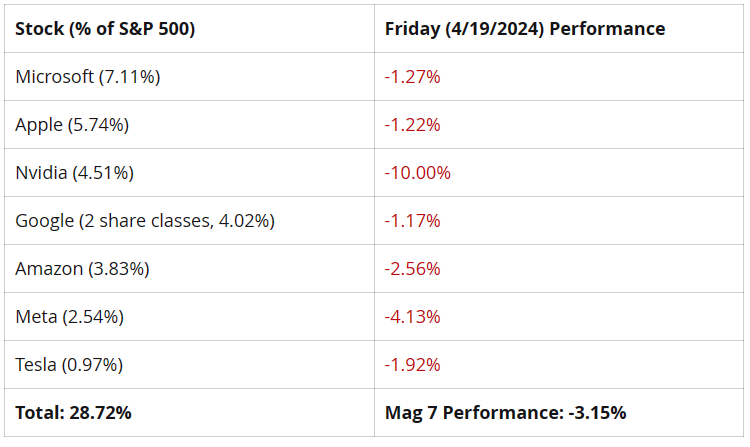

Friday’s trading day was a prime example of the impact that technology-related stocks have on the S&P 500’s movement. Technology-related stocks play a huge role in how the market fluctuates. The “Magnificent 7” stocks (Microsoft, Apple, Google, Nvidia, Meta, Amazon, and Tesla) account for nearly 29% of the S&P 500’s movement. The Information Technology and Communications sectors combine for nearly 40% of the index’s market capitalization.

On Friday, the S&P 500 declined by -0.88%. The Information Technology sector fell -2%, while Communications declined -1.10% and Consumer Discretionary (containing Amazon and Tesla) fell -0.88%. Meanwhile, Financials (the second largest sector) rose +1.38%. While the S&P 500 declined -0.88%, the equal stocks weight S&P 500 rose +0.38%.

Eighty percent of the S&P 500 stocks outperformed the index on Friday. The market’s largest components, those technology stocks that have risen substantially, are what caused the market to decline. Here is a breakdown of the Magnificent 7’s Friday performance, ordered from largest stock to smallest:

Stock S&P 500 weightings sourced from SPY holdings. Daily performance sourced from Yahoo Finance. Mag 7 Cap weighted performance calculated by Canterbury. Every effort was used to provide accurate data and mathematical calculations to provide, what we believe to be, accurate results.

To summarize the table above, Magnificent 7 stocks were down a collective -3.15%. These seven stocks make up nearly 30% of the S&P 500’s capitalization. So goes technology, so goes the market.

Over the last week’s trading, it appears that the sellers have been in control. With the exception of Friday, every trading day last week saw the market open higher for the day, and then close down near its low. It should also be noted that trading volume last week was extraordinarily low. Meaning not as much conviction.

Last week’s decline occurred on low volume. All five trading days last week had volumes ranking among the lowest ten for the past six months. It was the lowest trading volume week in the last six months for the S&P 500. So, there wasn’t a lot of volume that caused the week’s decline.

According to the Investor Sentiment Survey, which is conducted by the American Association of Individual Investors, bullish sentiment dropped last week while bearish sentiment rose. The survey showed that 38% of investors surveyed indicated that they had a bullish, or positive, outlook on the markets, while 34% held more pessimistic views. This is the lowest bullish sentiment and highest bearish sentiment reading since November 2nd, 2023. Which happened to occur after the markets low on Oct 27th.

Investor sentiment is a contrarian indicator. Typically, investors feel most bullish near peaks and most bearish near troughs. At the market’s recent peak in late March, bullish sentiment was at 50%, while bearish sentiment was at 22%. Now that markets have pulled back, sentiment has shifted. For reference, the latest sentiment readings are within range of the historical average. Historically, bullish sentiment has averaged 37.5%, while bearish sentiment has averaged 31%.

Markets were shaky last week. Most of the trading days opened higher yet closed near their lows. Market weakness was led by large technology stocks. Those same stocks carried the markets higher last year. The volatility of technology stocks rose about 12% last week.

Last week’s decline was the lowest volume trading week in the last six months. Each trading day’s volume ranked in the bottom ten of largest volume for the last six months. The low volume arguably points to low conviction, but we are a little concerned that each day last week opened higher, while closing lower. Last week, the market experienced a pullback, and has not yet shown that it wants to go back up. For it to want to go back up, technology stocks will have to do some of the heavy lifting. Perhaps this week with earning releases scheduled for many companies’ things will shift again. Source Brandon Bischoff.

The Week Ahead

A busy week awaits, highlighted by global flash PMI readings, U.S. GDP and inflation updates, and Japan’s central back meeting. In the U.S., investors will focus squarely on Thursday’s first estimate of Q1 GDP and Friday’s Core PCE Price index, both of which could have significant implications for the Fed’s policy course. Consensus estimates point to around 2.5% GDP growth in the first quarter, down from 3.4% in Q4 2023. However, the Atlanta Fed’s GDPNow model suggests that number may come in even higher, and an upside surprise could keep upward pressure on interest rates and further reduce the likelihood for rate cuts this year. Meanwhile, core PCE is expected to rise 0.3% MoM and 2.8% YoY, numbers that aren’t likely to change FOMC members’ hawkish sentiments expressed last week.

Earnings season ramps up this week with reports due from United Parcel Service, Tesla, Meta Platforms, Microsoft, Intel, and others. Other U.S. data of note include new and pending home sales, durable goods orders, and personal income and spending figures. Overseas, the Bank of Japan’s interest rate decision arrives Thursday evening along with an inflation update. The BOJ will also release its quarterly outlook on prices, and an upward revision may be in order as the yen hovers near 34-year lows against the U.S. dollar. China’s central bank is expected to leave benchmark lending rates unchanged this week as it looks to stabilize the yuan. In Europe, the PMI data should provide insights as to whether the nascent recovery seen in March is extending into the second quarter. Germany’s business and consumer sentiment readings are also scheduled for release. Australia’s CPI report and Canada’s retail sales figures round out the international agenda.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/