Nvidia, AI and

Weekly Market Review

for February 26th 2024

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week In Review

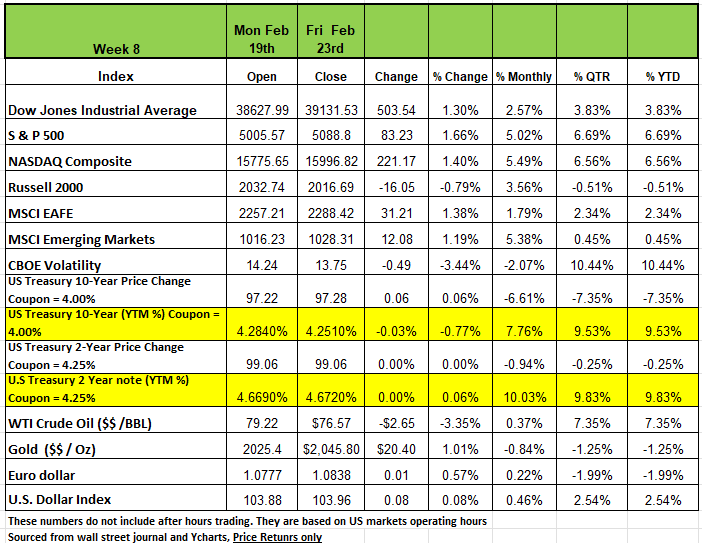

Three of the 4 major indices were up on the week with the Russell 2000 being the lone index with a negative return on the week ending Feb 23rd. The S&P 500 index rose + 1.7% to a new record close as stronger-than-expected quarterly results from retailer Walmart (WMT) and chipmaker NVIDIA (NVDA) boosted investor sentiment. The NASDAQ followed with a +1.4% return and the DOW with a +1.3% return

The S&P 500 also reached a fresh intraday high on Friday at 5,111.06. The index is now up 5% for the month to date and up 6.7% for the year to date. The NASDAQ is up +6.56% YTD and the DOW +3.83%

The weekly advance was led by the consumer staples and technology sectors amid excitement over the quarterly results from Walmart and NVIDIA. For its fiscal Q4 ended Jan. 31, Walmart reported adjusted earnings and revenue above analysts' expectations. The company also boosted its dividend and unveiled an agreement to acquire entertainment technology company Vizio Holding (VZIO) for $2.3 billion in cash.

NVIDIA's shares, meanwhile, rallied on better-than-expected results for the company's fiscal Q4 ended Jan. 28. Sales more than tripled from the year-earlier quarter amid strong demand for generative artificial intelligence, and the company issued upbeat guidance for its fiscal Q1 revenue.

NVIDIA's report sent the chipmaker's stock to a $2 trillion market capitalization for the first time ever and sparked a rally across technology stocks and others touched by artificial intelligence.

The Treasury yield curve flattened further as short-term yields rose moderately while long-term yields dropped moderately over the course of the week on a strong equity market that fueled speculation that the Federal Reserve Bank would not cut rates as aggressively as previously anticipated.

Treasury yields began the week rising moderately as investors continued to debate if there would even be a rate cut during either of the next two Fed meetings, or even if the central bank could raise the Fed Funds Rate again. The yield curve flatted on Thursday as Nvidia reported strong earnings and guidance, causing a rally in the equity markets and investors to speculate that the economy may be running too hot for the Fed to cut rates.

On Friday, economists at Goldman Sachs gave the view that he Fed would not cut rates until the June meeting. The market implied Fed Funds Rate for the end of 2024 rose during the week from 4.46 to 4.51 as the market implied probability of a rate cut during the March 20th meeting dropped to just 2.0%.

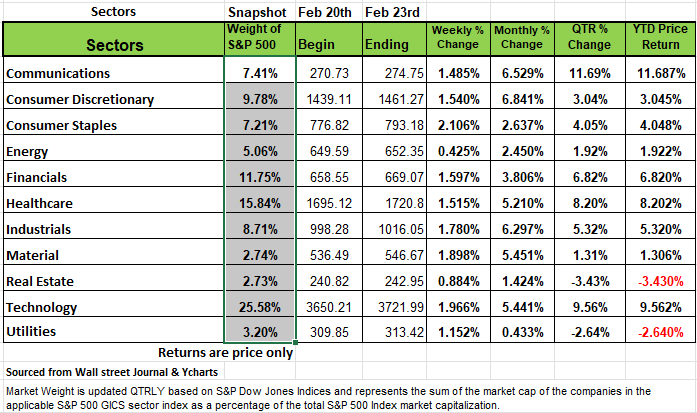

By Sector

Every sector of the S&P 500 rose on a weekly basis, led by a +2.1% gain in consumer staples and a +1.96% rise in technology. Other strong gainers included materials +1.90%, industrials +1.78% and financials +1.60%. The smallest increase was posted by energy, which edged up +0.4%.

In consumer staples, Walmart's shares rose 3.1% on the week amid its better-than-expected earnings report, dividend boost and Vizio deal. Among other gainers in the sector, shares of Kraft Heinz (KHC) rose 3.6% as the food, beverage and snacks company reiterated its 2024 financial outlook at a conference.

The technology sector's advance was led by an +8.5% climb in NVIDIA's shares on the week, followed by an +8.2% increase in the shares of fellow chipmaker Micron Technology (MU).

The energy sector's small gain came as crude oil futures declined. Shares of APA Corp. (APA) shed -4.9% as the company reported Q4 adjusted earnings per share below analysts' mean estimate despite higher-than-expected revenue.

Elephant in the Room

It’s hard to talk about the markets without addressing the meteoric rise of NVVIDA. AI continues to be one of the most profound developments of our lifetimes, and many believe it has the ability to push US productivity growth comfortably above 3% annually by the end of this decade. There will be hiccups along the way, but with Nvidia already up +47% YTD and + 239% in 2023 (the best in the entire S&P 500), and now the 3rd largest company in the world, it is clear that the enthusiasm for AI is undimmed.

So, what is it about Nvidia’s chip that is so different from the other chip makers?

Most chip companies such as intel produce CPU chips (Central Processing Unit) which is the primary component of a computer that acts as its “control center.” It’s constructed from billions of transistors; the CPU can have multiple processing cores and is commonly referred to as the “brain” of the computer. It is essential to all modern computing systems, as it executes the commands and processes needed for your computer and operating system. The chips work on a point-to-point system for processing information

Nvidia produces a GPU (Graphic Processing unit) chip, the chip has been around for years and has generally been used for software programs that involved a lot of Graphics or videos. The GPU is a processor that is made up of many smaller and more specialized cores. Graphics processing uses something known as Vector math to create these 3D worlds on computers and this same math is also used by AI to reach its outcomes.

By working together, the cores deliver massive performance when processing task can be divided up across many cores at the same time (or in parallel). The GPU is an integral component that you need for these cloud service providers to build out these big data centers to serve all these new AI applications and Nvidia was in the right place at the right time

Now to make things more confusing there are new chips entering the market call LPU’s

The LPU is a special kind of computer brain designed to handle language tasks very quickly. Unlike other computer chips that do many things at once (parallel processing), the LPU works on tasks one after the other (sequential processing), which is perfect for understanding and generating language. The LPU is designed to overcome the two LLM bottlenecks: compute density and memory bandwidth.

However, the chips are just one component in Al, there is the rest of the hardware which is why SMCI ‘s stock has skyrocketed over the last year and most importantly the programing. AI is nothing more than mathematical calculations for predicting the probability of an outcome.

AI has two distinct problems, one problem is training, which is when you take a model and take all of the data that you think will help train it. You do this so that you train the model to learn over time from the data (information) the 2nd problem is what many call inference which is what we all see every day as a consumer such as going to the platform (Googles Gemini) and asking it a question. One requires heavy machines to process the other requires speed. these are generally harware issues.

However, the programing (training) can be subject to biases. For instance, google AI platform Gemini would not produce accurate photos of the founding fathers of America. It landed the platform right in the middle of an online culture war, the platform came under fire for what critics have called a pro-diversity bias. The controversial images soon went viral with the help of high-profile public figures like Elon Musk. Google has since responded by temporarily suspending Gemini’s ability to generate images of people.

The issues were that the programing they developed had guard rails in place which backfired to meet goggles principles. For instance, to be socially beneficial to avoid creating unfair biases and avoiding stereotypes.

AI needs to be unbiased. It needs to be truthful and accurate. If you are using AI such as ChatGPT to write a paper or article, you should be able to rely on it for accuracy. Not to change or tweak issues to favor a particular bias or outcome. You cannot put a filter on what you think truth is One other component for AI to be beneficial to an individual is that is will require a lot on data on that person. Will we feel comfortable with personal data in the hands on an unknown?

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

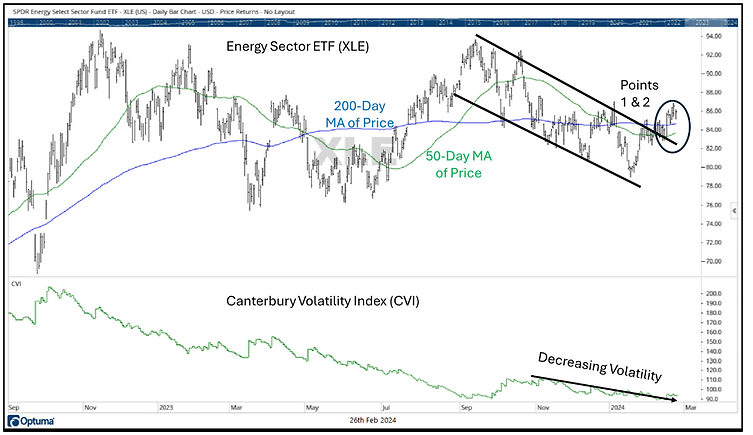

Chart of the Week- Energy

The sector is currently in one of our four “bearish” market states. This means that from a technical standpoint, the Energy sector has higher volatility, and a negative trend. Energy may be looking to turn things around. Look at the chart and corresponding points below.

The Energy sector has been in a downward-sloping channel since its peak in September. This “channel” can be visualized the descending lines drawn across the sector’s lower highs and lower lows. A few days ago, Energy attempted to break out of this pattern. Ideally, this would be the start of a new trend.

The blue line is the security’s 200-day moving average of price; the green line is its 50-day moving average of price. While the 50-day moving average is below the 200-day moving average (negative), the sector’s actual price is above both moving averages (positive). It would be positive if Energy can hold the 200-day moving for support, and we eventually see the 50-day moving average cross above the 200-day moving average.

Energy is one of the more volatile market sectors right now. High and increasing volatility indicates higher risk. That being said, the lower third of the chart shows that the volatility of the sector is declining. For the recent price channel (see point 1), the sector’s volatility peaked in November and has been declining since.

The Energy sector may have a low ranking relative to other market segments, but it is showing signs of life. Our indicators haven’t had a technical “buy” on Energy since late September. If current trends continue, it may have a technical “buy” rating soon. Source Brandon Bischoff (Canterbury Investments)

The Week Ahead

Major economic reports (related consensus forecasts, prior data) for the upcoming week include Monday: January New Home Sales (684k, 664k); Tuesday: January Prelim. Durable Goods Orders (-5.0%, 0.0%), February Conf. Board Consumer Confidence (115.0, 114.8); Wednesday: February 23 MBA Mortgage Applications (n/a, -10.6%), 4Q Second GDP Annualized (3.3%, 3.3%); Thursday: January Personal Income (0.4%, 0.3%), January Personal Spending (0.2%, 0.7%), February 24 Initial Jobless Claims (209k, 201k), February MNI Chicago PMI (48.0, 46.0); Friday: February Final S&P Global US Manufacturing PMI (n/a, 51.5), February Final U. of Michigan Sentiment (79.6, 79.6), February ISM Manufacturing (49.5, 49.1

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/

The Optimized Investor

CONTACT

320 W Ohio Street

Suite 328

Chicago IL 60654

312.263.1590 X 101

Gene@optfinancialstrategies.com

General Advertising Disclaimer This website is provided by Optimized Financial Strategies which is part of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/

All Rights Reserved | Optimized Financial Strategies | Website by Olive + Ash Design