The First Quarter of 2024 Market review

for April 1st 2024

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

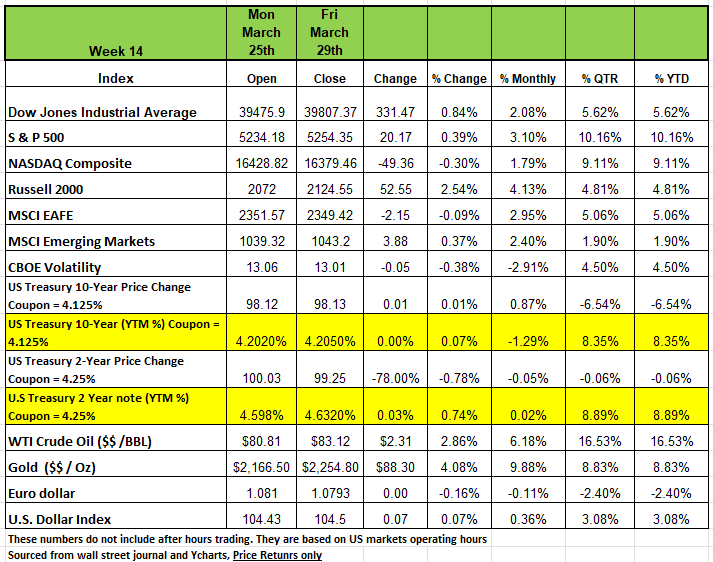

Last Thursday marked the end of the last week of the month of March as well as the first quarter of 2024. The markets have been on a tear since November of 2023, posting incredible returns. The Russell 2000 index posted the highest return for both the last week of the quarter and month of March with a +2.54% and +4.13% with a YTD return of +4.81% . The S&P return +0.39% on the shorten week +3.1% on the month and +10.16% on the first quarter of the year. The DOW posted 0.84% on the week with a +2.08% return on the month and +5.62% return on Q1. The NASDAQ was the only negative index on the week with a -0.30%but posted a +1.79% return on the month and +9.11% on the first qtr.

The quarter's gains have come amid corporate earnings and economic data that were mostly above forecasts, boosting expectations that the FMOC will start cutting interest rates this year. At the last press conference Powell reaffirmed projections for three rate cuts this year.

On Thursday the revised gross domestic product for Q4 grew at a 3.4% annualized rate, up from estimates for growth of 3.2%. The University of Michigan's consumer sentiment index was revised higher to 79.4 for March, surpassing the 76.5 reading expected in a survey.

Treasury yields ended the holiday-shortened week mostly higher, as only the 30 Yr. yield finished the week lower. February new single-family home sales declined 0.3% to a 0.662 million annual rate, falling short of the consensus expected 0.677 million. Following two consecutive months of gains, new home sales took a step back despite mortgage rates and home prices trending lower. New orders for durable goods rose 1.4% in February, beating consensus estimates of a 1.0% gain. After declining 58.9% in January, orders for commercial aircrafts rebounded and were up 24.6% to lead gains across most major categories.

The final report for real GDP growth in Q4 2023 was released last Thursday and revised higher to a 3.4%, coming in above a prior estimate and consensus of 3.2%. The higher number came as a result of upward revisions to consumer spending on services, commercial construction, and government purchases. Friday’s PCE report, the Fed’s favored measure of inflation, saw prices rise +2.5% in February, matching consensus expectations. Federal Reserve Chair Jerome Powell stated that while the data was “pretty much in line with expectations”, the Fed won’t be “overreacting” to the past two months of data which show an upward move in prices.

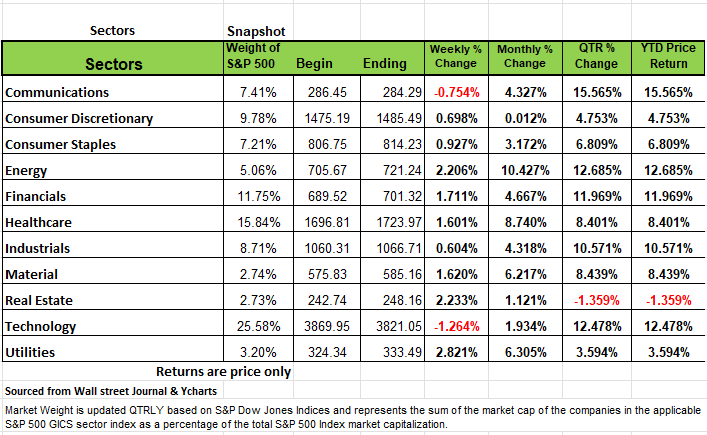

Sectors

Investors appeared to be trading cautiously ahead of the inflation report, all but two sectors posted weekly gains. Utilities led the advance, up +2.8%, followed by increases of +2.2% each in energy and Real Estate. However Real Estate is still the only sector in the red YTD. Financials, materials, health care, all rose by more than +1.5% consumer staples, consumer discretionary and industrials all rose by less than 1%.

The utilities sector's gainers included Constellation Energy (CEG) and Public Service Enterprise Group (PEG) as analysts at Morgan Stanley raised their price targets on both companies' shares while maintaining their investment ratings at overweight. Constellation Energy's shares rose 3.7% on the week while Public Service Enterprise Group's shares climbed 2.7%.

The energy sector's climb came as crude oil futures also rose. Gainers included EQT Corp. (EQT), which rose 7.9%, and ConocoPhillips (COP), up 3.5%.

The two sectors in the red were technology, down -1.3%, and communication services, down -0.8%. The declines came after the sectors were the strongest performers on a percentage basis last week.

The technology sector's decliners included shares of Oracle (ORCL), which slipped 1.7%. A Bloomberg report said South Africa's Special Investigation Unit asked the National Treasury to prohibit Oracle from doing business with the government over what it says is a flawed tender.

Are we in an Over Exuberant Market?

The first quarter of 2024 posted extraordinary returns. If we just look at the S&P 500 index, 76 companies or 15% of the members in the index posted a price return of 20% or more in just 12 weeks. The two largest returns were SMCI +255% and NVDA +82.28% Another 136 companies or 27% return between 10%-20%. Another 33% percentage had a return between 0.13% and 10% and the last 133 companies or 26.44% had a negative return with TSLA posting the largest decline of -29.25% The cap weighted index returned +10.16% while the S&P equal weighted index returned +7.91%. These are unusual numbers for the first few months of a new year. Maybe they can be justified by some as earnings were better than expected for fiscal year 2023. The economy seems to be resilient to the higher interest rates that we have seen over the last 18 months. The markets started the year off expecting 6 interest rate cuts in 2024 and with higher-than-expected inflation data that expectation was reduced to 3. The markets did not seem to flinch much and continued their upward trend with the S&P reaching all-time high levels.

However there seems to be a bit of confusion within the Fed itself. It appears that some of the Fed members are divided on the number of cuts in interest rates for 2024. At Powell’s press conference on March 20, he was confident the FOMC will see an imminent reversal in price increases and will deliver three interest rate cuts in 2024. The market’s response was to push the indices to new record highs. The total amount of those cuts has never been discussed and many pundits are speculating that rates will come down to 4.5% by year end. Many experts are still betting on rate cuts as early as June, this seems a bit overzealous considering that the most recent data is on an upward swing, not downward. But everyone is entitled to an opinion and there are plenty of conflicting opinions out there regarding the direction of rates.

There is a question circling among some investors on whether the rest of the FOMC voters are as optimistic as Powell. On Friday March 22 the president of the Atlanta Fed president Raphael Bostic stated that he favors just one cut for this year. On Wednesday, March 27, Fed Governor Chris Waller of the St Louis Fed questioned the three-rate cut view. Waller believes the U.S. economy is resilient and with a strong demand in labor will require the Fed to hold off on rate cuts. He thinks it prudent to keep rates at their currently restrictive level perhaps for longer than previously thought to put more pressure on inflation. He questioned whether the productivity gains that helped push inflation down last year are sustainable and noted that the number of FOMC voters expecting two or fewer cuts had increased at the March meeting.

In addition to Waller, Fed Governor Lisa Cook said that inflation can return to 2% if the Fed is careful. But It is difficult to lower inflation when the labor market is strong, consumers want to spend when they have money in their pockets. It seems highly improbable to lower to the target level of 2% without impacting employment. But since the Federal Government flooded the economy with so much money, academics have no experience on how long it will take to normalize the economic environment.

The Markets hoped for a resolution when Powell spoke last Friday, March 29, but he was noncommittal. Powell repeated his base case, which remains a continued decline to 2% inflation, and in the less likely case that “inflation progress slows,” the FOMC will keep rates unchanged.

Powell ignored the higher inflationary aspects of last week’s PCE report and added that the economy is strong, so the central bank doesn’t need to be in a hurry to cut rates. March 10th will be the next CPI data release, if the numbers are higher again it seems like it the markets will need Powell saying, that we are not making progress on bringing inflation down to change the speed of this Bull Market.

A Technical Perspective

This week, we will be featuring a chart on the Utilities sector ETF (XLU). Just two weeks ago, Utilities had been the last ranked sector and was in the bottom half of our universe of ETF rankings. In the last week, the sector has moved up 30 spots in rank and given an alert that it may be starting to show better technical characteristics.

Let’s have a quick look at a chart of Utilities.

The Utilities Sector ETF has been in a clear downtrend, as shown by the descending black line drawn across the sector’s peaks. It has consistently registered lower highs and lower lows. Last week, the sector ETF broke out of this trend line with a new relative high, surpassing its peak from early November.

While the ETF has declined, volume indicators have mostly moved sideways. The MoneyFlow Index recently broke to a new high. Meaning , volume is confirming the recent move in price.

Utilities is above both its 50-day moving average of price and 200-day moving average of price. This is positive, but ideally, we would like to see the shorter moving average (50-day) cross above the longer moving average (200-day). This would strengthen the likelihood of a change in long-term trend.

Utilities was previously the worst ranked sector, and one that was in a significant downtrend, but is now starting to show more favorable characteristics. This echoes the statement that the market breadth (participation) is becoming stronger.

Sentiment Survey

The average investor has a positive market outlook right now. Fifty percent of individual investors surveyed by the American Association of Individual Investors indicated that they were “bullish” or thought that market would be higher six months from now. This reading was well-above the historical average of 37.5% bullish investors. The spread between bulls and bears is even greater. Only 22% of those surveyed indicated that they were bearish.

Sentiment readings are extraordinarily high and have been for the last few months. The AAII, who conducts the sentiment survey, states that the survey is a contrarian indicator, meaning that high degrees of bullish sentiment occur near market peaks, while high bearish sentiment occurs near market bottoms. Keep in mind that high degrees of sentiment can stay in place for awhile before reverting.

Right now, volatility is low, and market breadth has improved. We are seeing a rising tide lift most ships. That is a bull market characteristic. As Warren Buffet has stated be fearful when people are Greedy and Greedy when people are fearful. Keep your eye on the data and pay attention to your portfolio.

Source Brandon Bischoff

The Week Ahead

Q2 kicks off this week with reports on February construction spending, February factory orders and March US auto sales. Investors, however, will be heavily focused on March employment data due later in the week. Economists keep expecting the pace of job growth to slow, only to see a seemingly endless stream of upside surprises. The estimate for Friday’s non-farm payroll change is around 205K, down from 275K but still indicative of a robust economy. Earlier in the week, the JOLTS job openings and ADP private payroll reports will provide additional color. ISM PMI surveys arrive today and Wednesday, and particular attention will be directed to the prices paid component, as inflationary pressures have been percolating. Fed Chair Powell is scheduled to speak Wednesday at Stanford University, while other FOMC members will make appearances throughout the week. Other U.S. data include factory orders, trade balance figures, and consumer credit. On the international calendar, most of Europe and parts of Asia are quiet today due to holidays. On Tuesday things get started with Germany’s preliminary CPI reading for March, and the wider Eurozone CPI release is slated for Wednesday. Headline inflation is

expected to fall closer to the ECB’s 2% target, but core inflation has remained stubbornly high. The rest of the European docket includes EU retail sales and PPI, along with German factory orders. OPEC+ meets on Wednesday, but with oil prices firm since the group extended output cuts in early March, no policy changes are expected until the June meeting. China releases private sector PMI figures this week, on the heels of last weekend’s official government numbers. Last of all, Canada, which posted an encouraging GDP update last week, follows up with the central bank’s business outlook, jobs data, and PMI.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/

The Optimized Investor

CONTACT

320 W Ohio Street

Suite 328

Chicago IL 60654

312.263.1590 X 101

Gene@optfinancialstrategies.com

General Advertising Disclaimer This website is provided by Optimized Financial Strategies which is part of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/

All Rights Reserved | Optimized Financial Strategies | Website by Olive + Ash Design