More Noise &

Market Review

for

August 5th 2024

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

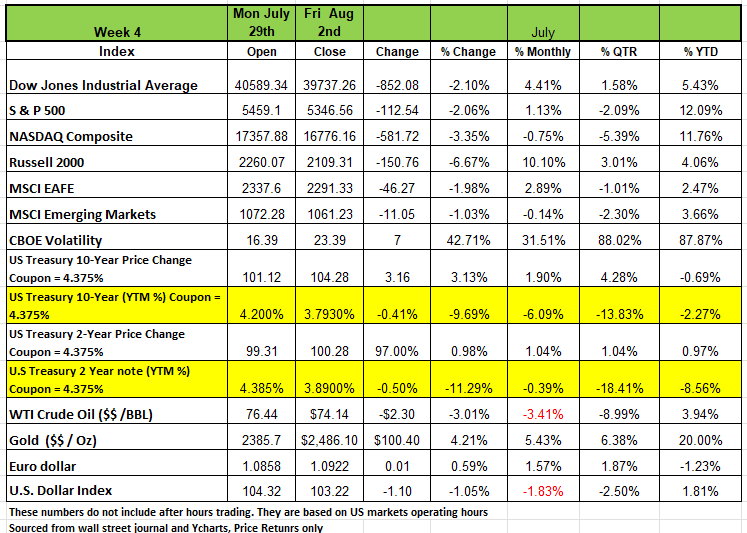

All four of the major indices declines last week with the Russell 2000 posting the sharpest decline with a -6.67% followed by the NASDAQ -3.35% the DOW -2.10% and the S&P 500 -2.06%. At the time of this writing the markets opened the trading week down significantly with all of them negative by more than -2% on the day.

The retraction in prices began one day after Fed Powells press conference following the FOMC July meeting which decided to keep interest rates steady at 5.25%-5.5%. The markets had expected this position from the Fed, so it came as no surprise. However, the declines came on some other economic news released last week with the economy only adding 140K new jobs, which was quite a bit shy of the 175K expected. In addition, May and June payrolls were revised down significantly, June payrolls saw a downward revision to a 179,000 increase and May payrolls were revised down to a 216,000 increase, for a net downward revision of 29,000 jobs.

The unemployment rate rose to 4.3% in July from 4.1%, the department said. Analysts were expecting the rate to remain unchanged month-to-month. Data released earlier in the week showed continued contraction in the US manufacturing sector for July amid weak demand, while weekly applications for unemployment insurance hit the highest level in close to 12 months.

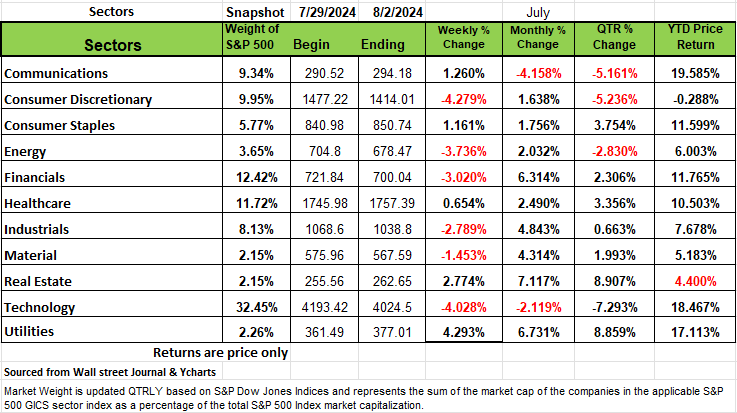

Consumer discretionary and Tech sectors fell more than -4% each, with energy -3.74%, financials, -3.02% industrials -2.78% and materials -1.45% for the week. Utilities led the gainers with a +4.3% increase, followed by Real estate +2.74%, Communication services +1.26%, Consumer Staples +1.16% and healthcare +0.65% all saw gains.

Treasury yields fell significantly last week on signs of a soft labor market, quickly shifting speculation from when the Fed will cut interest rates to how many. Once again, the markets are speculating on the Fed decisions as money flowed into Treasuries dropping yields and rising prices on higher coupon instruments. Yields fell significantly following the report, and the market now expects at least four rate cuts this year. Fed Chair Jerome Powell had previously said that a rate cut could come as soon as the Fed’s September meeting due to growing risks facing the labor market.

Additional economic data released last week showed that the ISM Manufacturing Index came in below expectations and fell deeper into contraction in July. Manufacturing has now contracted for 20 of the last 21 months, with July’s reading being the lowest since November of last year. Major economic reports (related consensus forecasts, prior data) for the upcoming week include Monday: July ISM Services Index (51.0, 48.8); Tuesday: June Trade Balance (-$72.5b, -$75.1b); Wednesday: August 2 MBA Mortgage Applications (N/A, -3.9%); Thursday: August 3 Initial Jobless Claims (242k, 249k).

Sectors

By Sectors Tech was dragged lower by an almost 32% slump in Intel (INTC). The chipmaker's Q2 financial results fell short of market expectations. The company outlined a $10 billion cost-cutting plan, including a more than 15% headcount reduction. Qualcomm (QCOM) sank 12% for the week on warning of a revenue hit from the US government's decision to revoke its license to export products to China's Huawei Technologies. Microsoft's (MSFT) fiscal Q4 intelligent cloud revenue missed Wall Street's estimates, while Amazon (AMZN) Q2 revenue trailed market views.

Consumer discretionary was weighed down by a 9.7% slump in Marriott International (MAR) after the hotel giant cut its full-year earnings outlook following a Q2 sales miss. McDonald's (MCD) jumped 9.8% after the fast-food heavyweight said nearly 93% of its restaurants in the US have committed to extending its $5 meal deal "even further" into the summer.

Hess (HES) dropped 8.6% for the week following a Q2 revenue miss, weighing on the energy sector. The financials sector posted a weekly loss despite a 6.3% rise in PayPal (PYPL). The digital payments company raised its earnings outlook following a Q2 beat. Mastercard (MA) rose 5.4% on better-than-expected quarterly results.

Industrials' weekly loss came even as C.H. Robinson Worldwide (CHRW) jumped 10% after logging better-than-expected Q2 earnings. In health care, Moderna (MRNA) slipped 29% after the drugmaker cut the full-year product sales guidance for its respiratory business amid growing competition in the US and low demand in the European Union. Merck (MRK) fell 8% after lowering its earnings guidance to reflect the costs tied to its Eyebiotech acquisition.

A 4.8% gain in Meta Platforms (META) buoyed the communication services sector. The Facebook parent's Q2 earnings and sales surpassed the Street's estimates, driven by stronger-than-expected advertising revenue. Utilities' gain came amid a 1.8% rise in Vistra (VST), which received 20-year licenses to continue operating the Comanche Peak Nuclear Power Plant through 2053

This week's major earnings include Walt Disney (DIS), Eli Lilly (LLY), Amgen (AMGN), Caterpillar (CAT), Uber (UBER), CVS Health (CVS), Paramount Global (PARA, PARAA) and Hilton Worldwide (HLT).

Noise

When it comes to investing you often want to look at several aspects of a company. One is their business model and how they create revenue and serve their customers. Warren Buffet created the term MOAT to evaluate the amount of competition a company might be vulnerable to in the marketplace. This brings us to think about the communication sectors and specifically media.

If you think about it for a minute the news business is the only industry that does not know what it is going to sell us tomorrow. So whatever the compelling topic of the day is they need to add as much sizzle to it in order to keep our attention. Since the creation of the 24/7 news cycle, internet, social media and the smart phone the digital landscape has become flooded with so called experts. Competition in both the digital space as well as traditional media outlets has blurred the lines between journalism and sensationalism due to the need to be first and shocking, but most importantly generate clicks and engagement in the online space. Social media’s rapid spread of information on social platforms often favors sensational content over nuanced reporting. All these organizations rely on advertising revenue, which incentivizes sensational content to drive traffic. While some may argue that it can be used as a tool to draw attention to important issues or make complex topics more accessible to a wider audience, its main objective is to condition us to become dependent on a specific platform.

So, Today’s environment has become filled with a lot of unnecessary Noise. The noise is filled with extreme narratives and for those that are not experts in a specific field they will often find themselves responding to the headlines and making irrational or emotionally driven decisions that often result in a consequence.

Case in point a few weak economic numbers, and all of a sudden, we move from a soft landing to a recession. While the economy is slowing, we are still far from a recession. A balanced assessment of demand and supply would suggests that we are merely transitioning to slower growth. What would anyone expect after the US government deployed $5 trillion dollars over an 18-month period. While a slower growth path is always a more vulnerable one, simply because excessive monetary ease is more likely to weaken than strengthen the economy in the short run. While there is potential for some outside shock Middle East, China & Russia and the US Presidential election, the baseline scenario should be a slowdown. Not a recession. Volatile markets remind investors of the importance of diversifying and paying attention to valuations. Blindly buying the Magnificent 7 just because they are the hot topic does not mean they are worth the price one would pay. The sensationalizing of the market causes irrational entry and exit. Fear and exuberance are not reasons to buy and sell.

While the mood on the economy has changed quite quickly, the economic headline from just 12 days ago was that real GDP growth had surprised to the upside, coming in at a robust 2.8% for the second quarter, well above the 2.1% consensus expectation. But the media will never keep things in context and remind us of these important facts. They are from too long ago. Last week we saw slightly higher-than-expected weekly unemployment claims, a lower reading on construction, durable goods orders, home sales and manufacturing activity. This was topped off, on Friday, by a softer-than-expected employment report, both in terms of payroll job gains and the unemployment rate. But when the job numbers are adjusted down, we don’t see to care as much, it’s old news and that is not as sensational as current data.

Softer economic data, combined with further signs of diminished inflation, had already led the Fed to signal an intention to cut rates, possibly in September. However, despite Chairman Powell’s position that rate cuts would be slow and deliberate, futures markets have almost fully priced in a 50-basis point cut in the federal funds rate in September and 125 basis points in cuts by the end of this year. This is again the same market that forecasted 6 rate cuts in 2024 with the first occurring back in March of this year.

This change in the outlook for the economy and interest rates has helped cut the yield on a 10-year Treasury from 4.48% at the start of July to just 3.79% today and de-inverting the yield on the 2- and 10-year treasury for a short period of time on Monday. Meanwhile, since peaking in the middle of last month, the S&P500 has fallen by almost 6% while the more tech-focused Nasdaq is down 10.0%. Correction territory. Evidence again that valuations are stretched, and a pullback would be normal.

For investors, all of this raises some important questions: One, what is the most likely near-term scenario – recession or just slower growth? It’s slower growth. Two, how is the Federal Reserve likely to respond and what does this mean for short-term and long-term interest rates? Markets do not dictate the Fed behavior consumers do. Lastly, given both the economic outlook and valuations across markets, how should investors consider adjusting their portfolios? This varies pending time horizon and one’s capacity for risk.

Any analysis of the short-term outlook for the U.S. economy starts with the consumer. Recent data appears benign, with real consumer spending tracking 1.6% annualized growth since the start of the year. It is true that the personal saving rate, at 3.4%, remains well below pre-pandemic levels and that sentiment remains gloomy. However, July should mark a 17th consecutive month of positive year-over-year real wage growth while, even with the recent selloff, the S&P500 is up over 12% year-to-date, adding to household wealth. More affluent households are clearly seeing a disproportionate share of these wealth and income gains. However, the economy counts by dollars, not by heads, and, so far, it looks like consumer spending will continue on a 1.0%-2.0% growth path for the rest of 2024 and maybe into the early part of 2025.

A few points to keep things in perspective, Capital spending appears resilient, with business investment climbing 3.6% in the year ended in the second quarter. Corporate balance sheets are strong for the most part and the rush of enthusiasm around AI technology is increasing spending. Yes, there is excess capacity in office space and some stress in the regional markets that have hit a few weaker companies and banks, but overall, nothing has collapsed. Keep in mind that 75% of the market cap is now reporting earnings for the second quarter, and so far, S&P500 earnings per share are tracking at a better than 10% year-over-year gain which should justify capital spending going forward.

In addition, homebuilding is subdued but at a level from which it is more likely to rise than fall, Consumer will get used to the increase in housing prices and with Treasury yields dropping so will mortgage rates. Inventory accumulation was a little above trend in the second quarter and may be a modest drag on growth going forward. However, state and local government spending continues to rise while the U.S. international trade position could be a problem.

So, unless there is a shock to the system, demand in the U.S. economy appears consistent with real GDP growth falling from 3.1% year-over-year in the second quarter to a pace of close to 1% for the rest of 2024 before recovering to 2.0% growth in 2025 these are recession numbers. So be careful of how much you believe the media could simply push enough fear into the consumer to cause a bigger slowdown

A Technical Perspective

The markets are off to a rocky start to begin the month of August. After finishing the month of July with a +1.57% day, the S&P 500 fell -1.37% on Thursday and -1.8% on Friday, before opening down -4% on Monday. This is certainly not the start investors would have hoped.

There have been a few different proposed “reasons” behind the decline in the first few days of August. Perhaps it is nerves from the upcoming election. We will know the US Presidential candidates and their running mates in the coming few days. This selloff could be a reaction to both the polls and speculative policies. Some may also attribute the selloff to the Federal Reserve being too slow to lower rates. Last week’s economic data showed that payrolls increased lower than expected, and the unemployment rate hit a 3-year high.

The selloff to open Monday’s trading has been widely credited to global concerns. As a reaction to poorer job reports in the US, the Nikkei index (Japan) tumbled over the weekend, declining by -12%. Part of this decline could be due to an unwinding “carry trade.” One popular investment strategy in the last few years has been borrowing foreign currency, such as the yen, for cheap and investing elsewhere at a presumably higher yield. In the last week, however, the yen has surged in value relative to the US dollar, causing investors to devest from Japanese assets and signal a “risk off” environment.

It’s tough to make rational sense of an irrational market. When it comes to markets, the fundamental reasons behind a fluctuation don’t really matter. What matters is supply and demand. One thing we know for sure is that this market selloff has been driven by technology-related stocks. There’s an old saying about the markets that says, “all parabolic advances end the same way.” We know that for the last two years technology-related securities have been the beneficiaries of high demand. Stocks, like the ones in the Magnificent Seven, have seen their prices rise to new highs, at an unsustainable rate. Investors become excited, thinking that their investment will begin to double and keep rising. As these stocks rise relative to their peers, they make up a greater percentage of a capitalization weighted index such as the S&P 500. Now, as investors become anxious and flee these securities, these stocks are leading the market’s volatility and have caused the market to drop fast. All parabolic advances end the same way- with a sharp drop.

Many of these Magnificent Seven stocks are now entering “Bear Market” territory. Bear markets are signaled by a series of irrational fluctuations and sustained high volatility. Across these seven stocks, 45% of the trading sessions since July 10th have been beyond +/-2%. Even volatile “up” days are not necessarily a good thing. You can see that last Wednesday, Nvidia rose +12%. The move probably confused many investors, who were hoping to experience continued gains, when that gain was wiped away in about three days.

The Market Was Due for an Outlier Day, and Technology Stocks Put it into Motion

If you were just looking at the market, and not its components, you might think that it was only a matter of time before markets experienced some short-term volatility. we monitor for “outlier days.” An outlier day is any trading day that exceeds +/-1.50%. During a normal, bull market year, outlier days happen infrequently, typically between 10-20 times per year. During bear markets, they can happen almost daily, in either direction.

Prior to late July, markets had not seen an “outlier day,” or trading day beyond +/-1.50% since April. When markets go extended periods with an outlier, volatility gets extremely low and “compressed” like a spring. Eventually, an outlier day or two will serve to release some pent-up energy. More often than not, market fluctuations return to normal following a few outliers.

The alarming part right now is that the outlier days are being driven by an already emotional and bearish technology sector. Technology stocks are experiencing much larger outlier days and causing emotional market swings. If these large securities do not stabilize and find footing, it could lead the entire market to experience more outliers than would be expected.

The Equal Weight S&P 500

We know technology is volatile, but it is important to keep an eye on the equal weight S&P 500. Unlike the S&P 500, which is capitalization weighted and has a very skewed allocation to technology stocks, the equal weight index evenly distributes its allocation across all 500+ components. The equal weight S&P 500 just set a new all-time high less than a week ago. Now, it is down about -5% from that high. While this is considered a normal pullback and the volatility of that index remains relatively low, we continue to monitor for rising volatility in that index.

Money has flowed into Other Equity Areas

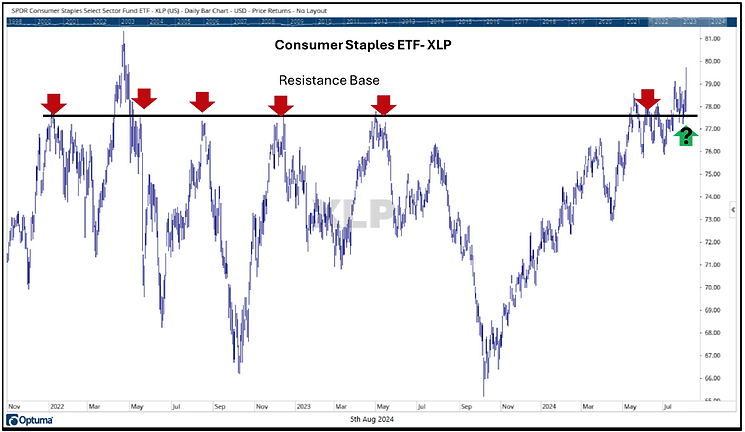

The recent selloff in technology-related stocks has driven up the demand for more defensive oriented securities. During Friday’s volatile move, the Real Estate, Utilities, and Consumer Staples sectors all set new highs for the year. Keep in mind that while these sectors are traditionally viewed as “defensive,” they tend to also decline during market downturns. As of right now, these sectors are generally rising, which is a positive.

As a matter of fact, last Tuesday, Proctor and Gamble (Consumer Staples stock) saw a -5% decline following an earnings report. By Friday, the stock had set a new all time high, while the market was selling off. Coca-Cola (Consumer Staples) stock also set a new high Friday, as did Southern Company (the second largest Utility stock). Even T-Mobile, which is in the Communication Technology sector, set a new high.

The chart below shows XLP, the Consumer Staples sector ETF, which includes Proctor and Gamble, Coca-Cola, Walmart, and Costco. You can see that the sector ETF appears to be breaking out of a multi-year base of resistance. If sustained, this would be a positive for the sector.

When dealing with markets, one of the best pieces of advice is “do not try and make rational sense of something that is irrational.” For the last week, the markets have been irrational. While markets took a punch to the face in the trading session on Monday, given the volatility that began early last week, there’s an argument that the market could have opened up +4% as opposed to down. If the market continues to be volatile, you can pretty much flip a coin as to which direction the market will fluctuate on a given day.

It remains to be seen whether or not recent market movements are evident of an impending bear market, a release of pent-up volatility, or a short-term rebalancing of market sectors and shift in leadership. There is not enough evidence yet that says where the markets will head. There is, however, evidence that suggests many technology-related stocks are in a bear market. The large fluctuations seen in the Magnificent Seven stocks, whether those daily fluctuations have been up or down, is not a positive. Even seeing a large upward move in these securities would not signal a bull market for technology.

From a portfolio management perspective, markets have shown us that now is a time to make some adjustments to maintain stable and consistent portfolio volatility. Our Adaptive Portfolio Strategy, the Canterbury Portfolio Thermostat, happened to own positions in Consumer Staples stocks, like Proctor and Gamble and Coke, as well as a Utility stock like Southern Company. If volatility continues to rise, we will employ the use of more defensive securities, like inverse ETFs, which can help stabilize portfolio fluctuations. We will continue to monitor market fluctuations and adapt the portfolio to whichever environment comes next- bull or bear. Contributed by Brandon Bischoff

The Week Ahead

The calendar of events for this week is much lighter than last, which is typical following the U.S.

employment data dump. However, the market’s heightened volatility due to economic growth concerns may not subside anytime soon, keeping investors on their toes as mostly second-tier data is released. In the U.S., today’s ISM services PMI may garner added attention after last week’s disappointing manufacturing number. Later this week, 10- and -30-year Treasury auctions will be scrutinized for demand after last week’s plunge in interest rates. The rest of the U.S. calendar includes July’s trade balance figures, consumer credit, and the quarterly loan officer survey. Earnings season is winding down, with just a handful of potentially impactful reports on tap from Disney, Caterpillar, Super Micro Computer, Uber Technologies, and Occidental Petroleum. Overseas, the Reserve Bank of Australia is expected to keep interest rates steady when it meets this evening. Last week’s softer core CPI reading likely took any additional rate hikes off the table, welcome news for Australian consumers. China releases inflation and trade balance information this week, while the Bank of Japan’s Summary of Opinions and minutes from last week’s meeting will be revealed.

Finally, Europe is relatively quiet, with investor confidence, producer prices, and German manufacturing data the only items of note on the docket.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/