Economic News

Week Ending February 12th 2021

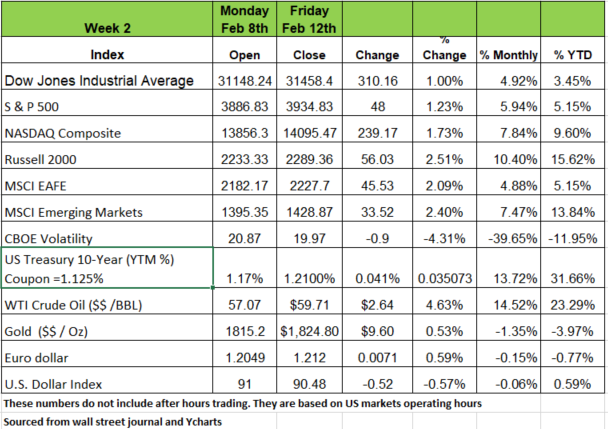

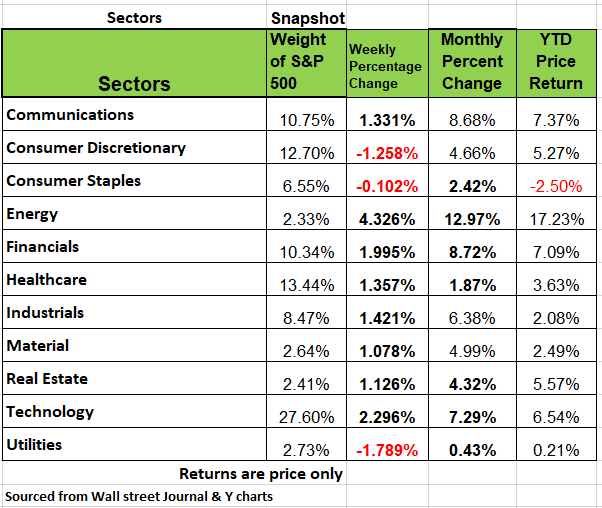

Last week seem fairly uneventful. The markets continue to behave like they’re on steroids or some hallucinogen. Fundamentals seem to be insignificant in the valuations of companies, with PE ratios at the top 1% of their historic range. All of the major indices were in positive territory last week with the Russel 2000 up 2.51% & 15.62% YTD, followed by the overseas indexes. Consumer Staples and Discretionary sectors were both down last week a sign that spending is slowing. Last month the stocks that performed best in the market were the ones with the worst fundamentals. This behavior typically occurs when markets reach their peaks, however this does not mean that this cannot keep going until some event triggers the correction. The markets have already discounted a rebound in Q3 so the continue rise seems to be challenging even in this detached market environment.

Fixed Income

Treasury yields moved slightly higher last week, while the 30-year Treasury yielded more than 2% for the first time since February 2020. The moves higher came as the market continues to price in the prospect of more government stimulus and higher economic growth as COVID-19 vaccines rollout.

Inflation expectations also moved higher as the 10-year breakeven rate, or the difference between the yield on a nominal bond and one indexed to inflation, reached its highest level since 2014.

Economic news, initial jobless claims were 793,000 in the week ended February 6 and have steadily improved from a winter peak of 927,000 last month, suggesting the labor market might be turning a corner as certain parts of the economy start to reopen. Major economic reports are due out later this week. Watch how the markets respond to the information

Labor Market Challenges

It appears that there has been no “net” progress in the labor market since the end of September. Unemployment claims for the week ending 2-6, were 813K, that seems like an improvement from the prior week of 850K. However, the worst number during the 2008 recession was 700K and we know how long that took to turn around. The health of the economy has always been and will always be measured by the health of the labor market.

The latest CBO (Congressional Budget Office) projections think GDP will return to pre-pandemic levels by mid-2021Government transfer payments grew by 36% in 2020 and with most people receiving more than they made while employed, we may be well on our way to creating a society that becomes too dependent on the government. But the same CBO projections states that GDP won’t reach its potential until 2025 and the actual number of employed people won’t reach the pre-pandemic level until 2024. That is 3 years from now. The Fed can not continue giving people money in hopes of things getting better, especially with so much debt owed for unpaid mortgages and rents. Many economists think that the stimulus will have little effect on the economy in relation to the amount the government is spending surveys show approximately 30% may go back into the economy. 30% will boost savings, 18% will pay down debt and 22% will go to back due rent. not quite the return the government is hoping for.

Source Bob Barone PhD economist.

New York looking to impose a transfer tax on securities

New York like many other states with large cities is facing a serious financial problem due to the shut down from the pandemic. Spending kept going while revenues stopped. Now they face serious deficits and are looking to tax the public in anyway they can. The State is looking to impose a transfer tax on all securities transactions. While a transfer tax was in place between 1905 and 1981 legislators are looking to reimpose this tax. If so a number of large financial firms as well as the New York Stock exchange itself would relocate their business. The industry made it very clear that it would not tolerate such a tax and a relocation would be a devastating blow to N.Y.C as well as the real estate market there.

Borrowing Binge reaches Riskiest Companies

Demand for debt securities is fueling a lending boom by Wall Street to some of the riskiest companies, even as the pandemic continues to drag the economy. More than $13 billion of that debt had ratings triple-C or lower—the riskiest tier for outright default—about twice the previous record pace. Also known as Junk Bonds the onslaught of “Zombie” companies can borrow at interest rates once reserved for the safest type of debt

The average yield for bonds in the ICE BofA U.S. High Yield Index was just 3.97 By comparison, the yield on the 10-year U.S. Treasury note, which carries essentially no default risk, was as high as 3.23% less than three years ago. The 10-year Treasury yielded was 1.2% Friday.

Source: https://www.wsj.com/articles/borrowing-binge-reaches-riskiest-companies-11613385001?mod=hp_lead_pos1

Is what's best for you, bad for the economy

The consumer is the backbone of the U.S. economy & appears to be in pretty good shape. Despite having more than 10 million U.S. workers unemployed due to the pandemic, the U.S. consumer continues to show signs of being fiscally responsible in this difficult climate.

Experian reported that the average FICO Score in the U.S. hit an all-time high of 710 in 2020. The Consumer Credit Default Composite Index stood at 0.46% in Dec / 2020, down from 0.96% in Dec / 2019 & well below its 1.78% average since July/2004

But does this savings help the economy? On the one hand, it's great for the individual but not great news for the economy

Since the U.S economy depends on consumer spending the new drop of helicopter money may not go where the politicians want it to go. Source https://www.cnbc.com/select/average-fico-score-hits-record-high-in-2020/

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/

The Optimized Investor

CONTACT

320 W Ohio Street

Suite 328

Chicago IL 60654

312.263.1590 X 101

Gene@optfinancialstrategies.com

General Advertising Disclaimer: This website is provided by Optimized Financial Strategies which is part of Optimized Capital, LLC (the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves a potential risk of loss and investors should be prepared to bear losses. Investments should only be made after a thorough review with your investment advisor, considering all factors including personal goals, needs, risk tolerance and most important capacity for risk. Optimized Capital is registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements.

All Rights Reserved | Optimized Financial Strategies | Website by Olive + Ash Design