Does the Government know what its doing?

& Market review

for the Week of June 10th 2024

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Market Recap

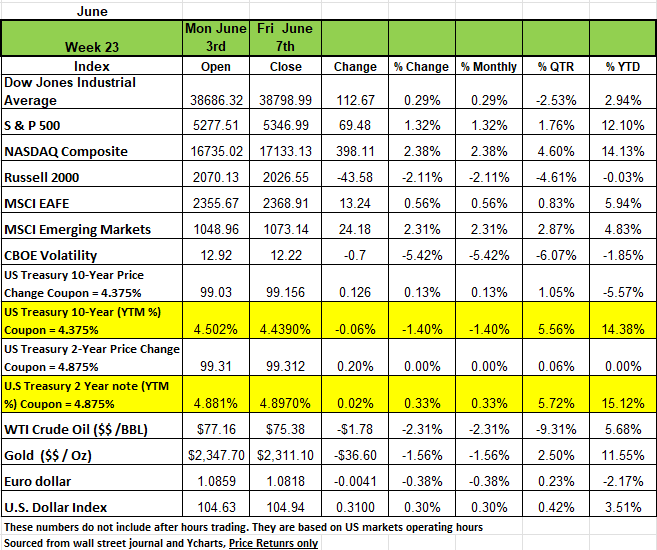

Three of the 4 major indices were up last week with the Russell 2000 being the only index to post a negative return on the week -2.11%. The NASDAQ posted the largest increase with a +2.38% return. Followed by the S&P 500 +1.3% and the DOW with a +.029% weekly gain, much of this was aided by a rally in Nvidia shares (NVDA) +10.2% as the stock split 50/1 at end of day last Friday. This morning the stock opened at $120.88/share.

Last week investors digested the jobs report which showed that the economy added +272,000 jobs in May, smashing the 180,000-increase expected. In addition, investors are looking ahead to FOMC meeting and Powells press conference scheduled for Wednesday afternoon shortly after the CPI numbers are released for May.

The markets are expecting the Fed to hold interest rates steady at this week’s meeting and at the end of July, according to the CME FedWatch Tool.

The focus on Wednesday’s meeting will likely be on the FOMC's Summary of Economic Projections, which could indicate just how much longer rates will stay at the current level.

The FOMC tightened monetary policy by 525 basis points between March 2022 and July 2023 and has since kept interest rates unchanged since the last increase. However, the downward momentum of inflation seems to have stalled and has shown signs of reigniting for the first few months of 2024. A hotter CPI number could cause markets to pull back significantly and increase the probability of a hike rather than a cut.

On the manufacturing side The Institute for Supply Management released its data last week showing a contraction in the US manufacturing sector activity for May, the ISM Manufacturing number dropped to 48.7 from a prior month’s reading of 49.2, as consensus expectations called for an increase to 49.5 anything below 50 is considered a contraction, the services sector did expand in May.

Treasury Yields dropped moderately over the course of the week on the mixed economic data and speculation about the next move from the Federal Reserve Bank. This unexpected drop in the ISM number caused investors to speculate that the Fed would have to do more easing to help the economy and Treasury yields dropped significantly. This drop in yields continued through Wednesday as the ADP Employment Change was also lower than consensus expectations, fueling speculation that the Fed may provide more than one rate cut before the end of the year. However, the optimism was replaced with concern on Friday after the payrolls report. This led investors to speculate that the economy is not cooling as fast as hoped and that the Fed would have to hold off on rate cuts a while longer. The market implied expectations for rate cuts started the week pricing in a full rate cut by the December meeting and a 45% chance of a second cut, which rose to a 98% chance of a second rate cut by Thursday, before dropping back down to just a 47% chance of a second cut on Friday. The market implied Federal Funds Rate at the end of 2024 started the week at 4.965, dropping to 4.836 on Thursday, before rising back to 4.963 on Friday. This alone shows how much the markets have focused on speculation on the Fed’s next move than any other fundamental components of the economy.

Sectors

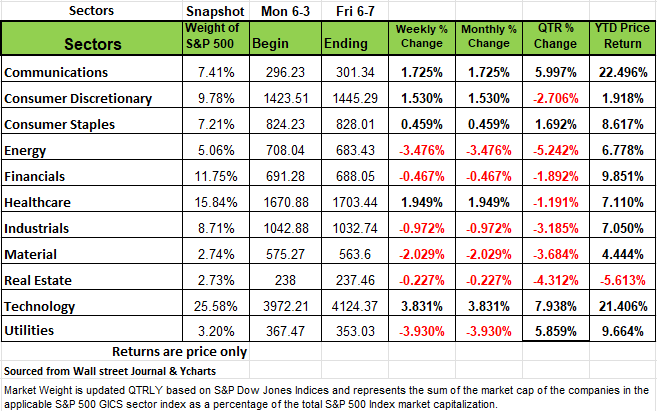

Five of the 11 sectors in the S&P 500 posted positive gains in the week. The technology sector rose +3.8%, the best performer, followed by health care, communication services and consumer discretionary, all up more than +1.5% each. Consumer staples rose +0.5%.

Utilities and energy posted the steepest declines, down -3.9% and -3.5%, respectively, and materials fell 2%. Industrials, financials and real estate also closed lower.

Consumer discretionary rose 1.5% amid a 1.9% gain in Lululemon Athletica (LULU), which lifted its guidance after delivering a fiscal Q1 beat. Bath & Body Works (BBWI) slumped 12% as it issued a downbeat Q2 earnings outlook.

Consumer staples' gain was offset by a 5.7% slump in Dollar Tree (DLTR), which cut its full-year earnings outlook. J.M. Smucker (SJM) rose 3% after the company logged better-than-expected fiscal Q4 earnings.

Does the Government Know what it’s doing?

Leave it to the government to screw things up, whether it’s the affordable care act, fiscal budgets-spending, or college education, anytime politicians try to make things better, they end up worse.

The Federal reserve is another example, it has an army of economists, that evaluate data, make assessments and work up new forecasts for monetary policy based on economic predictions. These academics are tucked away in their cubicles scrubbing data and working the information into their sophisticated models. But how accurate are these predictions that so many investors rely on? Not very.

One of the biggest mistake economists have made over the last century was to assume that all people were rational when it came to making financial decisions. But we have learned from Daniel Kahneman Richard Thaler and several other well-known economists that we are anything but rationale. Hence the assumptions made by academics often lead to poor decisions. A Key point in recent times is that no one saw the level of inflation from all the money printed during the pandemic. The economic surge triggered by the fiscal and monetary policies in response to the pandemic manifested into wild swings in output, unemployment and asset pricing. As we have mentioned in past blogs, never has any government infused so much money into an economy in such a short period of time. So, there is no history to study to understand the effects of such action, the impact it had in the short term, stimulated an economy that stopped suddenly, however the long-term consequences have yet to be seen and any predictions made by these academics is at best wishing thinking.

These academics are continuing to make mistakes and at best guessing on the outlook of the economy. To make matters worse they are continuously adjusting the data to make their models produce the results that make them look like they have a handle on the situation. In addition, the very narrow road by which they thought inflation could be tamed without triggering a recession, turned out to be not so narrow after all and just because nothing has happened yet does not mean it won’t or be painful when it does.

According to the data the U.S. economy has maintained solid economic growth with a very tight labor market even with higher interest rates. Companies we thought would struggle with higher rates seem to be holding on, stresses in a several regional financial institutions have been deflected and the commercial real estate market has yet to collapse with occupancy’s dropping to all-time lows.

But is the economy really that resilient? Or is the current growth a residual from the several trillion dollars that was put into the economy over the 24 months of the pandemic? In addition, geopolitical risks abound with the middle east, Russia and China issues and then we have our own political turmoil with the pending election (which carries the potential for significant policy changes regarding taxes, immigration and trade) and the criminal trials of the former president and the current President’s son.

We are divided as a nation, and we could have severe economic consequences. Government data appears to be less reliable, with huge gaps emerging between estimates of output and income. Seasonal adjustments continue to distort the numbers and produce discrepancies between the two main employment sources.

Last week’s numbers of new jobs went up significantly, as well as the unemployment rate, that doesn’t seem to make sense. The members of the FOMC will, as usual, provide their best guesses as to the direction of the economy based on the information provided to them by all the academics at the Fed, and their sophisticated and inaccurate models, but how poor are the Feds decisions based on the info they are given. Is sitting and waiting the best choice for the economy or is it the safest for now.

This week will be pivotal for markets, as more data on inflation and continuing questions about the Fed position on interest rates cuts and an economic soft-landing. The markets have been pricing in rate cuts since Oct of 2023 and assets prices seem to be stretch quite a bit based on these rate cuts. The highlight of the week will be Powell’s press conference Wednesday, the consensus is that the Fed is unlikely to change either short-term interest rates or their current pace of quantitative tightening. The Fed will also release a new Summary of Economic Projections, or SEP, and a new “dot plot”, showing their expectations for key economic variables and short-term interest rates. While the track record for these projections has historically been inaccurate the market will still be impacted by them, positively or negatively.

The SEP should include forecasts for four economic variables:

Year-over-year real GDP growth,

Headline PCE inflation,

Core PCE inflation and

The unemployment rate.

These forecasts are provided for the fourth quarters of 2024, 2025 and 2026. Which seems a waste of time considering just how inaccurate these have been in the past.

The March projections forecast real GDP growth for 2024 of 2.1%. Three months later, this forecast may be off target. Q1 revised GDP came in at 1.3% down from the 1.6% estimate. Consumer spending on health care, travel and entertainment continues to grow strongly, mostly because prices have risen so drastically. However, spending on non-durable goods, such as food and clothing, was lower in April than in December, implying that lower and middle-income households are having to cut back to make ends meet. Investment spending on structures and equipment is slowing, probably due to higher interest rates. Keep in mind that these investments have a lag because of the time needed to plan for these developments and hence the startup of these investments will also lag once rates become more economical for the projects. With the payroll job surge in May, many expect year-over-year real GDP growth to slide from 2.9% in Q1 to 2.0% by Q4 in line with the Fed’s numbers, unless consumer behavior changes. But the predictions for 2025 and 2026 seem to be too far out to project accurately for now.

In March, the SEP showed the unemployment rate rising from 3.9% in February to an average of 4.0% by the fourth quarter. Last Friday’s jobs report showed an unemployment rate of 4.0% in May, or 3.96% taken out to two decimals. It is quite possible that the Fed will boost its unemployment rate forecast to 4.1% or even 4.2% for the fourth quarter to reflect the lagged impact of slower economic growth. But in this new gig economy some of those numbers can be far off those collecting unemployment which is where the data comes are often working as a 1099 worker either as a Lyft/uber driver or other contract worker. Something the academics are not considering.

We made mistakes during the pandemic and for political reasons are slow to correct them. We are using data that is adjusted and making decisions that are based on that manipulated data.

Fed Chair Powell’s opening statement will likely be the same as previous ones, the Fed will continue to be data dependent. He may address to recent data showing slightly higher inflation and slightly higher unemployment.

The “dot plot” will very likely show an adjustment in expectations for Fed policy over the next 24 months. In March, 10 of 19 FOMC participants forecast three or more rate cuts in 2024 while 9 forecast two or fewer. What will they do this time? It is very likely that the new dot plot will show fewer changes maybe one at most but if more rate cuts are expected the economy would have to decline significantly.

Hopefully, Powell will address the two major employment surveys showing radically different things about the U.S. economy. According to the payroll survey, the economy gained a booming 2.8 million new jobs over the past year. However, according to the household survey, it only added a paltry 376,000 workers over the same period. Perhaps they need to address the part time job issue where people are counted multiple times based on the number of part time jobs, they take to make ends meet.

This is not the only discrepancy. Nominal GDP, adding up the components of output in the economy, grew by +5.4% in the year ended (12 months) in the first quarter. However, adding up all the income received in the economy and making appropriate accounting adjustments shows only a +4.3% gain on the other side of the ledger. The statistical discrepancy – the amount by which the income and output accounts of our national income statements disagree - has now swelled to $621 billion, or more than 2% of GDP. This seems to be that we have a larger underground economy, off the grid untaxed income

The real question everyone cares about is the health of the economy which appears to be ok for now–maybe it’s a little cloudy for some more conservative investors. Much like 2001 and 2008 when prices increase dramatically in a short period of time they tend to revert to their mean. If the markets experience a significant correction, we could see the dominos fall quicker than expected.

The Week Ahead

Wednesday’s U.S. consumer inflation report and FOMC meeting make this a pivotal week. Last week, the Canadian and European central banks initiated the first interest rate cuts in this cycle, and although the FOMC is not expected to act until September at the earliest, all eyes will be on the updated dot plot projections at this meeting. May CPI will be released just a few hours before the Fed’s statement and is forecast to cool to +0.1% MoM and +3.3% YoY. The producer price report follows on Thursday. Other U.S. economic data to watch include 10- and 30-year Treasury auctions, as well as June’s preliminary consumer sentiment and inflation expectations. On the international calendar, the Bank of Japan is scheduled to release its monetary policy statement Thursday evening. Recent inflation data has been mixed, so while the central bank may announce a reduction in bond purchases, it is likely to wait for more information on wage gains and private consumption before raising rates again. China publishes May CPI and PPI numbers Tuesday evening, and producer prices are expected to remain in deflation territory. Finally, in the UK, monthly GDP and employment reports are on the docket. If wages and economic growth come in elevated, last month’s hotter-than- expected inflation numbers in combination with these factors could impact the odds of a Bank of England rate cut in September.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/